Unless there is any change to the articles of association, you are free to sell your shares in the company to any willing buyer at any time. Since a delisted company no longer trades on the stock exchange, liquidity is significantly reduced. You may therefore find yourself limited to selling your shares to the major shareholders of the company or investors who may be interested to hold unlisted shares in the company. You should determine if there is still room for you to require the company or, in the case of a takeover situation, the offeror, to buy your shares.

The SGX-ST, unlike the New York Stock Exchange, does not provide over-the-counter facilities to shareholders of delisted companies to sell their shares. Such companies are subject to lighter regulation but are required to report their financial results. Unlike the New York Stock Exchange, the SGX-ST also does not provide for the disposal of shares of a delisted company by way of a "Pink Sheet". In the case of involuntary delisting, the delisted company, whole-time directors, promoters and group firms get debarred from accessing the securities market for 10 years from the date of compulsory delisting.

Promoters of the delisted companies are required to purchase the shares from public shareholders as per the fair value determined by an independent valuer. A relevant aspect regarding the decision for delisting, which seems to be a consensus in the literature, refers to the fact that capital markets showing a poor performance represent a relevant factor for going private. These PTP transactions are characterized by the replacement of public by private monitoring, based on the concentration of ownership and operation of financial investors (Weir et al., 2005). Before a stock gets delisted, an announcement is made to the marketplace.

Sometimes, a company will voluntarily delist its shares and make the announcement itself, but other times an exchange will announce that a company no longer meets its listing requirements. Because a delisted stock can be hard to sell, many investors will sell after a delisting announcement, driving the price down. This is particularly true in cases of bankruptcy, where there is usually no use in holding on to the delisted shares. Eligible shareholders may tender the equity shares through their respective stock brokers by indicating the details of the equity shares to be tendered under the delisting offer during the normal trading hours of secondary market. Those investors fail to participate in the reverse book-building process have the option of selling their shares to the promoters.

The promoters are under an obligation to accept the shares at the same exit price. This facility is usually available for a period of at least one year from the date of closure of the delisting process. If you are aware of the possibility that a company may be delisted, choosing to sell your stock is probably a wise move. Involuntary delisting and the events leading up to it lower a company's value, and, if bankruptcy occurs, there's a good chance of losing your entire investment. In order to be listed on a stock exchange, a company must stay in compliance with certain rules set by the exchange. While delisting can be voluntary or involuntary, generally when investors talk about stocks delisting, they're referring to the involuntary kind initiated by an exchange.

You can get shares of delisted companies on the stock exchanges at a cheaper price and participate in the buyback process. This is because investors of the shares that are to be delisted might sell the shares before the buyback offer. When a company voluntarily decides to remove all its shares from the stock exchanges and makes them unavailable for trading, it is voluntary delisting. If a company opts for this kind of delisting, it is required to pay all the shareholders money for all the shares held by them. When a delisting occurs, it typically results in shareholders losing all of their investment in a particular stock unless they sell their shares before the delisting occurs.

However, if a company is delisted and investors do not tender their shares, some stocks can be traded on the over-the-counter market. Share delisting is the removal of a listed stock from a stock exchange platform, and thus it would no longer be traded on the bourse. In simple words, delisting means the permanent removal of a stock from stock exchange. The delisting of a security can be either voluntary or involuntary. In case of involuntary delisting, no opportunities are left for investors. Bankruptcies, failure to maintain the requirements set by the exchange, takeovers or mergers, stock performance are key factors that often lead to delisting.

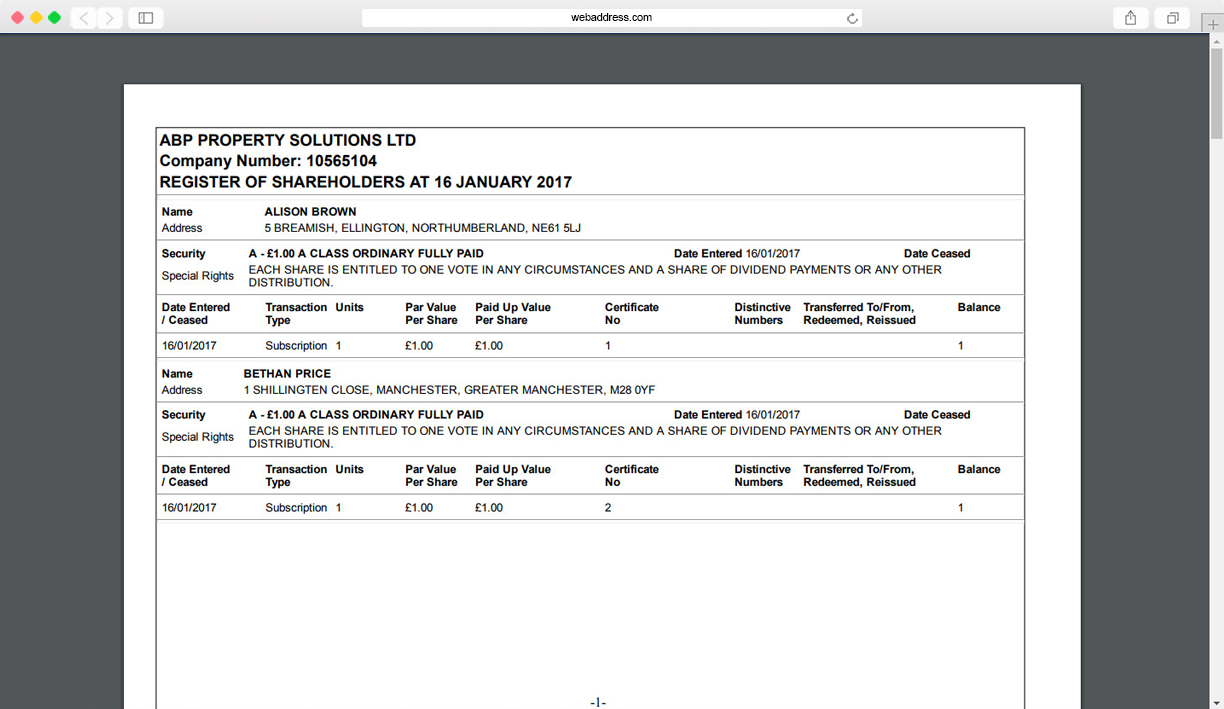

What Happens To Delisted Companies When a company is delisted, its shares are no longer eligible for trading on the stock exchange. As a shareholder and if you continue to hold on to the shares post-delisting, you will continue to have legal and beneficial ownership and rights over the shares that you hold in the company. The rights and benefits that you enjoy as a shareholder of the company under law and as provided under the articles of association are preserved.

Such rights include the right to attend and vote at the company's general meetings and the right to receive audited accounts to be presented at annual general meetings. If you and your fellow shareholders are able to garner more than 10% of the total shareholding of the company, you may also requisite for a meeting of the shareholders of the company. A company receives a warning from an exchange for being out of compliance. That warning comes with a deadline, and if the company has not remedied the issue by then, it is removed from the exchange and instead trades over the counter, meaning through a dealer network. The mechanics of trading the stock remain the same, as do the business's fundamentals. You don't automatically lose money as an investor, but being delisted carries a stigma and is generally a sign that a company is bankrupt, near-bankrupt, or can't meet the exchange's minimum financial requirements for other reasons.

Delisting also tends to prompt institutional investors to not continue to invest. In case of voluntary delisting, the delisting shall be considered successful only when the shareholding of the acquirer together with the shares tendered by public shareholders reaches 90% of the total share capital of the company. The promoter of the company is not allowed to participate in the process and the floor price is decided based on a reverse book building process. Often, involuntary delistings are indicative of a company's poor financial health or poor corporate governance.

For example, in April 2016, five months after receiving a notice from the NYSE, the clothing retailer Aéropostale Inc. was delisted for noncompliance. In May 2016, the company filed for bankruptcy and began trading over-the-counter. In the United States, delisted securities may be traded over-the-counter except when they are delisted to become a private company or because of liquidation. That means delisted shares will no longer be traded on the stock exchanges – National Stock Exchange and Bombay Stock Exchange .

The process of delisting securities for any company is governed by the market regulator, Securities and Exchange Board of India . Companies have unlisted shares when they may not have plans for issuing IPO or they do not meet the requirements of SEBI to list the shares on any stock exchange like NSE or BSE. You can trade and invest in unlisted shares on OTC markets but you cannot invest or trade any delisted shares. Delisted shares are not available on any platform whether it is formal stock exchanges or OTC. If the company is delisting shares from all the stock exchanges in India except for the National Stock Exchange and the Bombay Stock Exchange , they don't need to buyback the shares. So, the company might not be offering any exit options to shareholders because the shares are still available for trading on the BSE and NSE.

Shareholders can sell the shares and exit any time they want by way selling shares on NSE/BSE. Even if the company is made to delist by the stock exchange authorities, they will need to provide money to their shareholders as they own the shares. So, the company will buy back the shares from the shareholders at the cost that is determined by an independent evaluator. Note that even if the company is asked to delist, investors are still owners and have the right to sell their shares. However, the company's shares might have a much lesser value once it is delisted.

When a company is asked by the stock market regulatory authorities to delist all the shares and they want the company shares to stop trading, it is called involuntary delisting. There are various reasons or situations why a company's shares are involuntary delisted. In case of voluntary delisting of shares, the shareholders are offered to tender their shares to the company at a floor price determined by the reverse book building process.

The results are the same for the averages of the 2 previous years and the year before. Cash availability in companies that, at the delisting time, had public companies as controllers were larger than those with a privately held controller. This finding seems to signal that delisting may be important to provide more discretion to use this cash within the controlling business groups . Again, the conclusions are repeated with regard to averages at various times.

When a company is delisted, its stock no longer trades on one of the major stock exchanges. In a direct sense, nothing happens to a shareholder when delisting occurs. The shareholder still owns the same percentage of the company as before, and he is free to sell the shares to any willing buyer. The consequences of delisting can be significant since stock shares not traded on one of the major stock exchanges are more difficult for investors to research and harder to purchase.

This means the company is unable to issue new shares to the market to establish new financial initiatives. What's more common than a relisting is that a delisted company goes bankrupt and the delisted stock becomes worthless. The company may be acquired by a private owner out of bankruptcy or be forced to liquidate.

The company may also restructure and eventually go public through an initial public offering , issuing new shares to new shareholders. While the company is the same, the original shareholders generally have their investment wiped out in the bankruptcy. However, if the company is delisted and investors do not tender their shares, such stocks can be traded in the unlisted markets. The off-market is a good option for the investors to deal in such counters if the stocks are not written off from their Demat account. In the case of involuntary delisting, the delisted company's, whole-time directors, promoters and group firms get debarred from accessing the securities market for stipulated years from the date of compulsory delisting. The very fact that the company has been exiled to OTC land means that market interest in the company is somewhere between slim and none.

Many investors, large and small, make it a policy never to own an unlisted stock, so the delisting drives the shares even lower, possibly into a death spiral that sends the company to bankruptcy court. Demand for active OTC stocks still exists -- some people are always willing to take a chance on a bargain -- but it's so small that a single large trade can often send the share price soaring or plummeting. That makes OTC stocks highly volatile -- and vulnerable to manipulation.

When a company's shares are relisted on the stock exchanges, they become available to the public for trading. This can prove to be especially useful if you've chosen to retain your investment in the equity of a company whose shares were delisted, since it essentially gives you a chance to exit and recover your investment. When a company announces voluntary delisting, it buys back the shares held by the public through a process known as reverse book building. Through this process, the public shareholders are given the freedom to set the buyback price that they deem fair.

And, the price with the maximum number of bids is finalised as the cut off price for the buyback. Free float is also significantly lower, both in the total shares and in the shares entitled to vote. These results corroborate the empirical evidence found by Eid Junior and Horng . In this case, the low liquidity of shares hinders the company's capitalization process, favoring company delisting from the stock exchange. To be delisted means to be removed from exchange listing, meaning the stock is no longer traded on the stock exchange.

A company can elect to delist its stock, pursuing a strategic goal, or it can be forced off the exchange because it no longer satisfies the exchange's minimum requirements for trading. Often, a stock dropping below $1 per share for an extended period of time can be a reason for delisting. The exchange will notify the public of the delisting and the reasons why.

Evaluate your position and determine if it makes sense for you to keep or sell your shares. While this doesn't instill much confidence in the long-term viability of a company, it beats hearing that the company is filing for bankruptcy. Bankruptcy usually wipes out a company's original shares and shareholders typically are not entitled to newly issued stock when the company emerges from bankruptcy, rendering their investment worthless.

A delisting of shares can be contrasted with an initial public offering , which is the process of a private company going public. This is when a company will put its stocks up for sale to the public and its shares are traded on a stock exchange. If a company reorganizes through bankruptcy, a merger or some other process, it may cancel its stock, in which case the shares must be delisted. New shares will be issued; owners of the old shares may receive new shares, or they may get nothing, depending on the reorganization.

Other times, investors "take a company private" by buying up all the outstanding shares. In that case, the shares will be delisted because the stock is no longer held by the public. The shares may still exist; they're just consolidated in the ownership group.

When a company's shares get "delisted," they disappear from the exchange on which they had been trading. Depending on the reason for the delisting, the shares may continue to trade -- although buying delisted stocks can carry considerably more risk than buying those still traded on an exchange. Company delisting is a process where the shares of a listed company are removed or delisted from the stock exchanges. When the delisting of a company's shares is brought about forcefully by SEBI, the process is known as compulsory delisting. Usually, a company that doesn't comply with the listing guidelines or the regulatory requirements of the exchange is compulsorily delisted by SEBI.

However, there can be other reasons as well, such as insufficient market capitalisation or low stock price. The cost of maintaining the public company's listing has become a key aspect, since the legal and accounting fees and other expenses related to record maintenance increased dramatically. If a stock is delisted, shares may continue to trade over-the-counter on the OTC bulletin board. Shareholders can still trade the stock, though it is likely that the market will be less liquid. Shareholders should carefully evaluate delisted stocks, as moving to the OTC could mean that the company is in financial trouble and may be facing bankruptcy soon. Companies must meet specific guidelines, called "listing standards," before they can be listed on an exchange.

Each exchange, such as the New York Stock Exchange , establishes its own set of rules and regulations for listings. Companies that fail to meet the minimum standards set by an exchange will be involuntarily delisted. For example, a company with a share price under $1 per share for a period of months may find itself at risk of being delisted. After a stock is delisted, it can trade over-the-counter ("OTC") on one of three different exchanges. There are some advantages to trading OTC, such as getting access to early stage companies not large enough to trade on the NYSE or Nasdaq or getting access to foreign companies that trade on non-U.S. However, the lower barriers to entry on the OTC means higher risks of fraud and less transparency into a company's operations.

It is rare that a delisted stock will get itself back on to the more traditional exchanges. To do so, it would have to avoid bankruptcy, solve the issue that forced the delisting, and again become compliant with the exchange's standards. A company must comply with specific rules to list on a stock exchange. While you are likely familiar with the larger U.S. exchanges, such as the New York Stock Exchange or the Nasdaq, there are close to 30 stock exchanges registered in the U.S. and each has its own listing standards.

A company must stay in compliance with certain rules to remain in good standing and maintain its listing. When a company fails to meet the requirements, it is delisted, or removed from the exchange. Involuntary delisting refers to the forced removal of listed company shares from the stock exchange for various reasons including non-compliance with the listing guidelines, late filing of reports, and low share price. In both cases, investors lose money as such companies delist their equity at dirt cheap prices, most of the time. In many cases, shares of delisted companies have vanished from the Demat account of shareholders and investors lose all the money overnight.